Flexible Funding with a Home Equity Line of Credit (HELOC)

Need fast funding to purchase, renovate, and resell properties for profit? Divine Equity’s fix & flip loans provide financing, quick closings, perfect for house flippers and BRRRR investors.

Flexible Funding with a Home Equity Line of Credit (HELOC)

Need fast funding to purchase, renovate, and resell properties for profit? Divine Equity’s fix & flip loans provide financing, quick closings, perfect for house flippers and BRRRR investors.

HELOC vs. Cash-Out Refinance

| Feature | HELOC | Cash-Out Refi |

|---|---|---|

| Type | Revolving credit line | Lump-sum cash |

| Rates | Variable (6–9%) | Fixed (6–7%) |

| Disbursement | Draw period: 10 years | Immediate full disbursement |

| Best For | Ideal for ongoing projects | Ideal for one-time expenses |

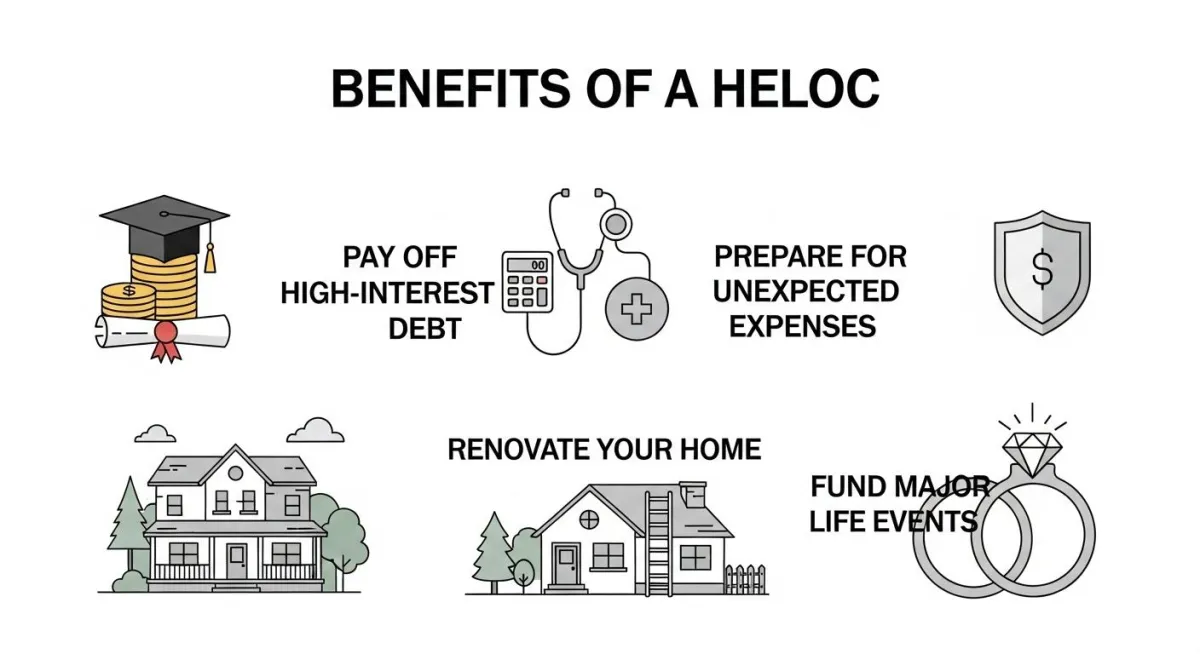

Benefits of a HELOC

✅ Interest-Only Payments – During the 10-year draw period.

✅ Reuse Credit – Pay down and borrow again.

✅ Use for Anything – Renovations, emergencies, investments.

HELOC Requirements

Credit Score: 680+

LTV: Up to 85% (primary homes) / 75% (investment properties)

Income Verification: W-2s, tax returns, or bank statements.

HELOC vs. Cash-Out Refinance

| Feature | HELOC | Cash-Out Refi |

|---|---|---|

| Type | Revolving credit line | Lump-sum cash |

| Rates | Variable (6–9%) | Fixed (6–7%) |

| Disbursement | Draw period: 10 years | Immediate full disbursement |

| Best For | Ideal for ongoing projects | Ideal for one-time expenses |

Benefits of a HELOC

✅ Interest-Only Payments – During the 10-year draw period.

✅ Reuse Credit – Pay down and borrow again.

✅ Use for Anything – Renovations, emergencies, investments.

HELOC Requirements

Credit Score: 680+

LTV: Up to 85% (primary homes) / 75% (investment properties)

Income Verification: W-2s, tax returns, or bank statements.

Frequently Asked Questions

We understand you might have some questions

Can I get a HELOC on a rental property?

Yes up to 75% LTV.

What happens after the draw period?

Repay over 20 years (fixed payments).

Are HELOCs tax-deductible?

Yes, if used for home improvements (consult a tax advisor).

Related Services

Cash-Out Refinance

Tap into your property’s equity for cash while keeping your mortgage.

Rental Property Loans

Long-term mortgages for buying or refinancing income-generating rental units.

Divine Equity All Services

View All the services Divine Equity has to help you.

Why 500+ Clients Choose Divine Equity

Fast approvals

Flexible Funding solutions

Expert Guidance

High Approval Rates

Lets get started

1. Consult: Tell us your goals (business, property, or both)

2. Match: We align you with the right services.

3. Execute: Get funded, compliant, and operational.

© 2025 Divine Equity - All Rights Reserved,

© 2025 Divine Equity - All Rights Reserved,