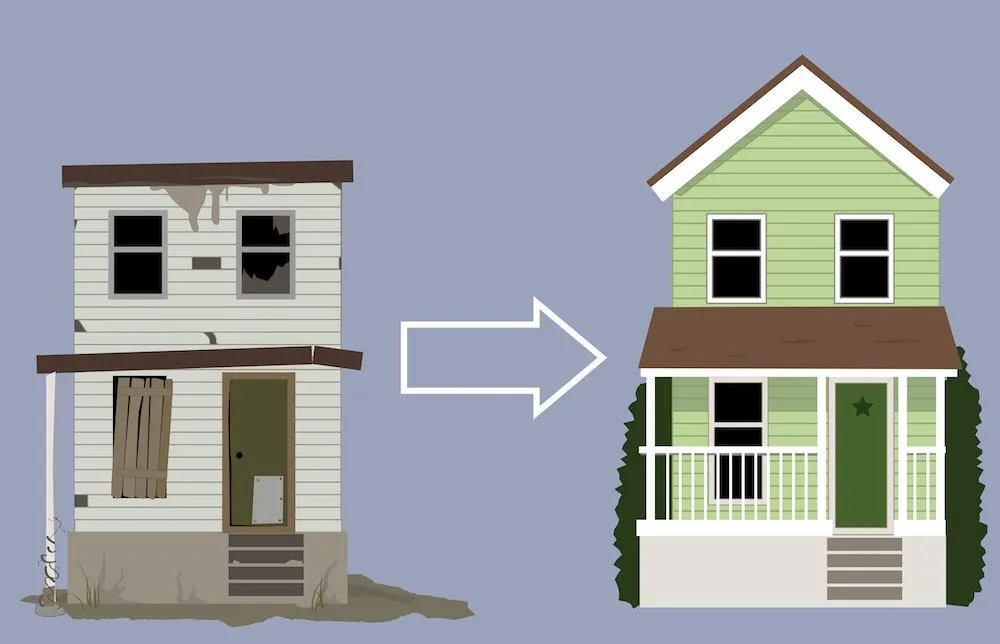

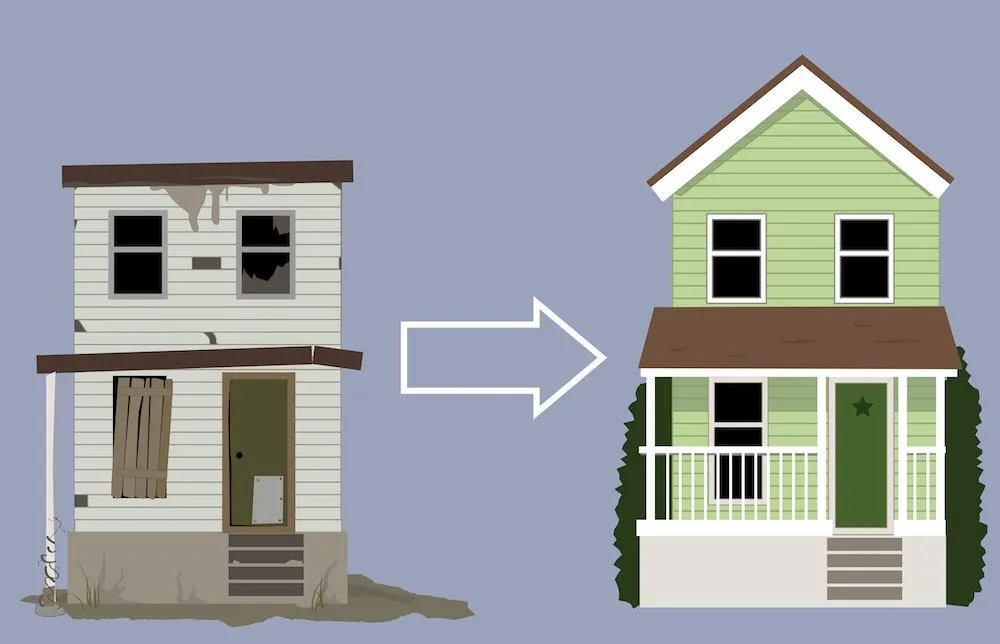

Fix & Flip Loans for Real Estate Investors

Need fast funding to purchase, renovate, and resell properties for profit? Divine Equity’s fix & flip loans provide financing, quick closings, perfect for house flippers and BRRRR investors.

Fix & Flip Loans for Real Estate Investors

Need fast funding to purchase, renovate, and resell properties for profit? Divine Equity’s fix & flip loans provide financing, quick closings, perfect for house flippers and BRRRR investors.

How Fix & Flip Loans Work

Loan Amounts: 50,000–5,000,000

Loan-to-Cost (LTC): Up to 90% of purchase + renovation costs

Terms: 6–18 months (interest-only payments)

Rates: Starting at 8% (based on experience & project)

Example Deal:

Purchase Price: $200,000

Rehab Budget: $75,000

Total Project Cost: $275,000

Loan Amount (90% LTC): $247,500

You Invest: $27,500 (10% down)

Why Choose Our Fix & Flip Financing?

✅ Fast Closings – Funded in 5–7 days (vs. 30+ days with banks)

✅ No Prepayment Penalties – Sell early and save on interest

✅ Experienced & New Investors Welcome

Eligible Properties

Single-family homes

Multi-family (2–4 units)

Condos & townhomes

Mixed-use properties

Have questions? click below

How Fix & Flip Loans Work

Loan Amounts: 50,000–5,000,000

Loan-to-Cost (LTC): Up to 90% of purchase + renovation costs

Terms: 6–18 months (interest-only payments)

Rates: Starting at 8% (based on experience & project)

Example Deal:

Purchase Price: $200,000

Rehab Budget: $75,000

Total Project Cost: $275,000

Loan Amount (90% LTC): $247,500

You Invest: $27,500 (10% down)

Why Choose Our Fix & Flip Financing?

✅ Fast Closings – Funded in 5–7 days (vs. 30+ days with banks)

✅ No Prepayment Penalties – Sell early and save on interest

✅ Experienced & New Investors Welcome

Eligible Properties

Single-family homes

Multi-family (2–4 units)

Condos & townhomes

Mixed-use properties

Have questions? click below

Fix & Flip Loan Requirements

Credit Score: 620+ (exceptions for strong deals)

Experience: 1+ completed flips (or partner with a contractor)

ARV Minimum: 1.25x total project cost

Reserves: 6 months of payments

Fix & Flip Loan Requirements

Credit Score: 620+ (exceptions for strong deals)

Experience: 1+ completed flips (or partner with a contractor)

ARV Minimum: 1.25x total project cost

Reserves: 6 months of payments

STILL NOT SURE?

Frequently Asked Questions

We understand you might have some questions

What if I go over budget on renovations?

We offer rehab escrow holdbacks for additional draws.

Do you fund out-of-state projects?

Yes! We lend in all 50 states.

Can I get 100% financing?

Yes, with a hard money partner (we can connect you).

Related Services

Construction Loans

Fund ground-up builds or major renovations with staged disbursements.

Private Lending

Flexible, asset-based loans for real estate investors, bypassing traditional banks.

Divine Equity All Services

View All the services Divine Equity has to help you.

Why 500+ Clients Choose Divine Equity

Fast approvals

Flexible Funding solutions

Expert Guidance

High Approval Rates

Lets get started

1. Consult: Tell us your goals (business, property, or both)

2. Match: We align you with the right services.

3. Execute: Get funded, compliant, and operational.

© 2025 Divine Equity - All Rights Reserved,

© 2025 Divine Equity - All Rights Reserved,